Gallery

Photos from events, contest for the best costume, videos from master classes.

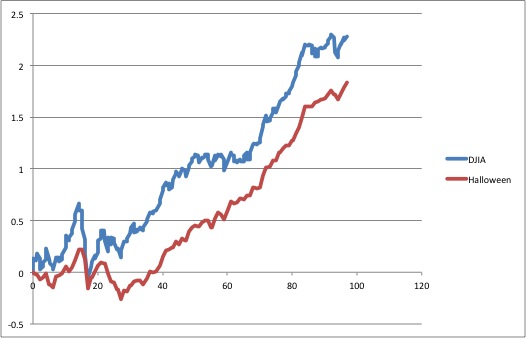

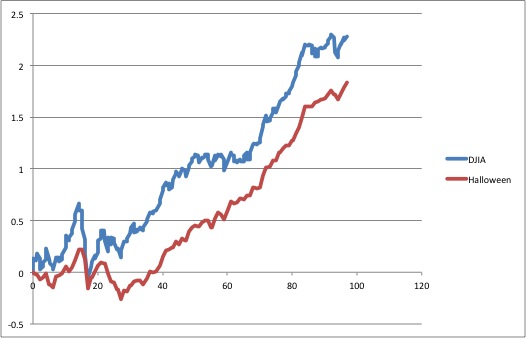

The Halloween Indicator: Sell in May and go away Sven Bouman ING Investment Management, Schenkkade 65, 2595 AS The Hague, The Netherlands. Ben Jacobsen Faculty of Economics and Econometrics, University of Amsterdam, Roetersstraat 11, 1018 WB Amsterdam, The Netherlands. e-mail: ben@fee.uva.nl November 1997 Abstract The Halloween Indicator, ‘Sell in May and Go Away’: Another Puzzle Sven Bouman AEGON Asset Management, P.O. box 202, 2501 CE The Hague, The Netherlands. Ben Jacobsen Erasmus University Rotterdam Rotterdam School of Management/Faculty of Business Administration Financial Management Department/RIFM PO Box 1738 3000 DR Rotterdam The Netherlands Since 2002 when Bouman and Jacobsen published their study on the Halloween Indicator, also known as the ‘Sell in May and go away’ effect, in the American Economic Review their study has stirred a fierce debate both in the academic literature and the popular press. BOUMAN AND JACOBSEN: THE HALLOWEEN INDICATOR alternative explanations-that we discuss later in this paper-but none of them seems to pro-vide an explanation for the puzzle. The Sell in May effect is an interesting puzzle for several reasons. Firstly, we find that it is-unlike other cal-endar effects-not only present in most devel- Since 2002 when Bouman and Jacobsen published their study on the Halloween Indicator, also known as the ‘Sell in May and go away’ effect, in the American Economic Review their study has stirred a fierce debate both in the academic literature and the popular press. Bouman and Jacobsen (2002) find that returns during winter (November through Findings suggest that the Halloween effect can still be observed in 34 out of the 35 countries. A more aggressive trading strategy of shorting the market during summer and taking a long position in winter yields 4.77% more than the buy-and-hold strategy. A new explanation is offered for the persistence of the Halloween effect. Bouman and Jacobsen (2002) develop a simple trading strategy based on the Halloween indicator and the Sell-in-May effect, which invests in a market portfolio at the end of October for six months and sells the portfolio at the beginning of May, using the proceeds to purchase risk free short term Treasury bills and hold these from the beginning Since 2002 when Bouman and Jacobsen published their study on the Halloween Indicator, also known as the ‘Sell in May and go away’ effect, in the American Economic Review their study has stirred a fierce debate both in the academic literature and the popular press. Bouman and Jacobsen (2002) find that returns Our simple new test for the Sell in May effect shows it not only defies stock market efficiency but also challenges the existence of a positive risk return trade off. When we examine the effect using all historical data for all stock market indices worldwide, we only find evidence of a significant positive ‘risk return’-trade-off during summer (May-October) in Mauritius. Pooling all We document the existence of a strong seasonal effect in stock returns based on the popular market saying Sell in May and go away, also known as the Halloween indicator. According to these words of market wisdom, stock market returns should be higher in the November-April period than those in the May-October period. The Halloween Indicator, "Sell in May and Go Away": Another Puzzle by Sven Bouman and Ben Jacobsen. Published in volume 92, issue 5, pages 1618-1635 of American Economic Review, December 2002 This paper investigates the existence of a calendar anomaly in stock market returns, namely the Halloween Effect, corroborated by Bouman & Jacobsen (2002). DOI: 10.1016/J.JIMONFIN.2020.102268 Corpus ID: 226191677; The Halloween indicator, “Sell in May and Go Away”: Everywhere and all the time @article{Zhang2021TheHI, title={The Halloween indicator, “Sell in May and Go Away”: Everywhere and all the time}, author={Cherry Yi Zhang and Ben Jacobsen}, journal={Journal of International Money and Finance}, year={2021}, volume={110}, pages BOUMAN AND JACOBSEN: THE HALLOWEEN INDICATOR alternative explanations-that we discuss later in this paper-but none of them seems to pro-vide an explanation for the puzzle. The Sell in May effect is an interesting puzzle for several reasons. Firstly, we find that it is-unlike other cal-endar effects-not only present in most devel- In this paper, we conduct a comprehensive investigation of the Halloween effect evolution in the US stock market over its entire history. We employ various statistical techniques (average analysis, Student’s t-test, ANOVA, and the Mann-Whitney test) and the trading simulation approach to analyse the evolution of the Halloween effect. The results suggest that in the US stock market the U.S. stock market sectors and industries perform better during winter than summer from 1926 to 2006. In more than two-thirds of sectors and industries, the difference in summer and winter returns, known as the Halloween effect, is statistically significant. There are, however, large differences across sectors and industries. The effect is almost absent in sectors related to consumer Since 2002 when Bouman and Jacobsen published their study on the Halloween Indicator, also known as the „Sell in May and go away‟ effect, in the American Economic Review their study has attracted a lot of attention in both the academic and popular press. BOUMAN AND JACOBSEN: THE HALLOWEEN INDICATOR alternative explanations-that we discuss later in this paper-but none of them seems to pro- vide an explanation for the puzzle. The Sell in May effect is an interesting puzzle for several reasons. This paper uses stock market returns (2007-2015) and confirms the existence of Halloween effect anomaly after the 2008 financial crisis. Findings suggest that the Halloween effect can still be observed in 34 out of the 35 countries. A more aggressive trading strategy of shorting the market during summer and taking a long position in winter yields 4.77% more than the buy-and-hold strategy. A In what is considered to be a seminal piece of research on the subject, “The Halloween Indicator, ‘Sell in May and Go Away’: Another Puzzle,” authors Sven Bouman and Ben Jacobsen were among the first to document a strong seasonal effect in global stock markets. In 36 of the 37 developed and emerging markets they studied between 1973 and

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.